|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

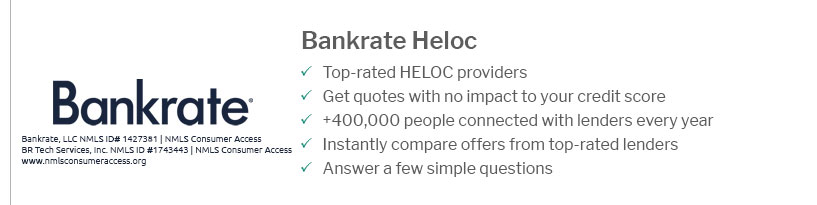

Discovering the Best HELOC Rates in CT: Your Guide to Home Equity LinesSecuring the best HELOC rates in Connecticut can significantly impact your financial planning. Understanding the factors influencing these rates is crucial for homeowners considering tapping into their home equity. Understanding HELOCsA Home Equity Line of Credit (HELOC) allows you to borrow against the equity of your home. It's essential to know how it works before diving into the Connecticut market. How HELOCs FunctionHELOCs operate similarly to a credit card. You have a credit limit based on your home equity, and you can borrow as needed. Benefits of a HELOC

Factors Affecting HELOC Rates in ConnecticutSeveral elements can influence the rates you'll encounter when searching for a HELOC. Credit ScoreYour credit score is a critical determinant. A higher score can lead to more favorable rates. Market ConditionsEconomic factors, such as inflation and the Federal Reserve's policies, play a significant role. For instance, understanding the cost of va streamline refinance can provide insights into broader market trends. Lender PoliciesDifferent lenders have varying criteria and policies, impacting the rates offered. Comparing HELOC Rates in CTShopping around is vital. Utilize resources and platforms to compare different offers effectively. Consider platforms where you can compare mortgage rates to find the best HELOC deals that suit your needs. FAQ

https://www.erate.com/home-equity/connecticut/home-equity-line-of-credit

To qualify for the lowest rate, a minimum draw of $25,000 is required at closing with automatic payments from an Eastern Checking Account. Minimum APR is 3.99%. https://www.membersfirstctfcu.com/Loan-Zone/Home-Equity/HELOC-Application

A Home Equity Line of Credit (HELOC) is a flexible financing option that allows Connecticut homeowners to borrow against the equity they have built up in their ... https://www.americaneagle.org/Learn/Resources/Rates/Home-Equity

Home Equity Rates (Subordinate Lien) ; 5-Year Fixed , 1 - 60 Months, 6.50% ; 10-Year Fixed , 61 - 120 Months, 7.00% ; 15-Year Fixed , 121 - 180 Months, 7.25% ...

|

|---|